Our Scholarship Granting Organization allows our donors to make gifts to Lafayette Christian School that directly benefit the scholarships awarded to our students who are most in need.

A School Scholarship Tax Credit is available to individuals or corporations who donate to SGOs for the purpose of supporting LCS students. Any donation made to an SGO designated for LCS will be applied directly to the cost of tuition for incoming or existing students who qualify. By designating your gift specifically for Lafayette Christian School you ensure that your gift will provide for an excellent education, centered in Christ.

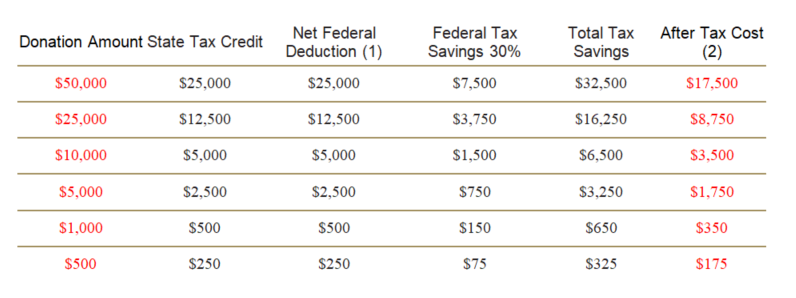

All donations to SGOs are eligible for a 50% state tax credit (not a deduction) that allows donors to minimize state taxes paid for this year’s income. In addition, the balance of the donation is eligible for a federal tax deduction.

For example, the following table illustrates an individual's after tax (state and federal) cost of a donation assuming a 30% federal tax income tax bracket:

Notes:

- There is no limit or minimum on the size of the contribution. However, the tax credit cannot exceed the State’s total credits awarded for the current fiscal year (July 1 – June 30). To see how much is still available in state tax credits, click here.

- Student recipients must meet certain family income levels to qualify for an SGO scholarship.

- Actual after tax cost will vary based on your individual income tax status. Consult your tax advisor for questions.

- Donors can carry over unused tax credits for up to nine (9) years.

- Lafayette Christian School's SGO partner is the Institute for Quality Education.

SGO gifts can be made by check (payable to the Institute for Quality Education), credit card (one time donation or monthly), or stock (see non-cash assets).

Lafayette Christian School

Lafayette Christian School